Tariffs are reshaping the global economic landscape, not due to political posturing, but because their effects ripple through supply chains, costs, consumer prices, and strategic planning.¹ For businesses, the era of 10% to 50% tariff volatility is here to stay, raising both obstacles and unprecedented opportunities. By approaching tariffs as an economic phenomenon rather than a political football, forward-thinking companies can move from cost-driven reactions to building true competitive advantage.

Tariffs now touch nearly every sector, from manufacturing and tech to consumer goods and automotive.² Their sudden swings disrupt established sourcing, unsettle pricing models, and force a wholesale rethink of cost management. As companies adapt, each company must ensure its strategy is closely aligned with its business goals, with departments and employees working together to build resilience and achieve organizational objectives.

Yet, these pressures have triggered a burst of supply chain innovation. “China Plus One” strategies have seen companies diversify sourcing to new regions such as Vietnam, India, Mexico, and Eastern Europe.³ Major multinationals, including Apple, have not only moved portions of their manufacturing out of China but have also invested heavily in developing secondary supplier networks. These strategies have created new value for stakeholders and a successful approach creates opportunities for both the company and its labor force.

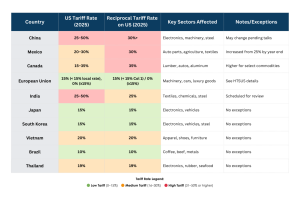

Major Trading Partners: 2025 US Tariff and Reciprocal Rates

(Source: The White House²)

Companies are also planning for the future by integrating lessons from recent disruptions into their strategic frameworks, ensuring they remain adaptable and future-ready.

Tariffs are more than just a headline—they’re a fundamental lever in international trade that every business leader should understand. At their core, tariffs are taxes imposed by governments on imported goods or services. The primary aim is to protect domestic industries from foreign competition, generate government revenue, and sometimes to influence the behavior of trading partners. In recent years, President Trump’s tariffs have brought this tool into sharp focus, as the U.S. has used tariffs to address trade imbalances and negotiate new agreements on the world stage.

For businesses, tariffs can mean sudden changes in costs, supply chain disruptions, and the need to rethink sourcing and pricing strategies. This is where management consulting services play a crucial role—helping organizations develop a successful business strategy that not only navigates tariff uncertainties but also leverages them for competitive advantage. Whether you’re a manufacturer, retailer, or service provider, understanding the basics of tariffs is essential for crafting a resilient business strategy and staying ahead in today’s dynamic global markets.

A 10% tariff on bananas imported from Guatemala has led to a direct price increase in grocery stores. For instance, Affiliated Foods raised the price of a case of bananas by 10%, from about $18 to nearly $20. Shoppers now pay 4 to 5% more for bananas compared to last year, which hits lower-income families hardest.⁴

Tariffs have raised the total cost of fresh produce by about 4% across U.S. supermarkets in 2025. This impacts essentials like coffee, seafood, and eggs, and results in an average annual grocery bill increase of $3,800 per household, an especially significant hit for families already managing tight budgets.⁴

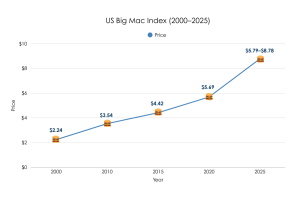

The Big Mac Index tracks the average price of a McDonald’s Big Mac in various countries and is a well-known way to visualize how tariffs and other factors impact consumer costs. In the United States, the average Big Mac price has climbed from $2.24 in 2000 to $5.79 in 2025, an increase of over 158%, reflecting both inflation and tariff-driven spikes.⁵ ⁷ ⁸

Recent blanket tariffs on imported beef contributed to a surge, with prices spiking almost 10% in 2025. This pushed the cost from $7.99 up to $8.78 at some franchises, a direct result of rising input costs and tariffs on key ingredients.⁹ Across the globe, the US now ranks among the world’s most expensive countries for a Big Mac, with only Switzerland, Norway, Uruguay, Sweden, and Canada posting higher prices.⁵ Currency exchange rates and tariff policies together make the US one of the world’s priciest places to buy a Big Mac, as exchange fluctuations and trade barriers drive up costs for imported ingredients.

When US tariffs rose on imported beef in 2025, Big Mac prices at some outlets jumped nearly 10% in a single quarter, pushing the price close to $9.00 for the first time.⁹ Similar price shocks hit other imported ingredients, illustrating how policy moves ripple quickly to everyday consumer staples.

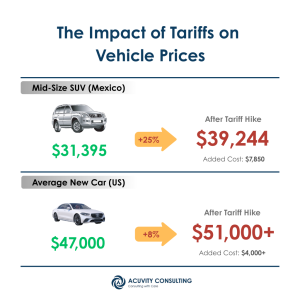

New tariffs on imported vehicles and car parts, including a 25 to 27.5% rate on many models from Mexico, Europe, and Asia, have had a dramatic impact on what Americans pay for new cars.¹⁰ ¹¹ ¹²

Within the automotive industry, companies are developing strategies to maintain investor confidence and adapt to changing market conditions, ensuring their responses align with both industry standards and the expectations of investors.

This surge is particularly tough on first-time buyers and families seeking affordable vehicles, but even luxury models now routinely see sticker prices north of $70,000. Electric vehicle buyers are also impacted, as recent policy changes cut popular tax credits, making tariff-driven price hikes even more painful in a tight market.¹⁰

While much of the tariff conversation centers on manufacturing and consumer goods, the healthcare sector faces its own unique challenges. Tariffs on medical devices, pharmaceuticals, and essential healthcare products can drive up costs for providers and patients alike, sometimes leading to shortages or delays in critical supplies. Domestic industries, particularly those involved in manufacturing medical equipment or sourcing raw materials, may also feel the pinch as input costs rise.

For businesses operating in healthcare, developing a robust go-to-market strategy is essential to manage these risks. Market research and in-depth analysis become indispensable tools for understanding shifting cost structures and supply chain vulnerabilities. By staying proactive and informed, companies can maintain their competitive advantage, adapt to new market realities, and continue delivering value to patients and partners—even as the tariff landscape evolves.

While higher input costs dominate headlines, tariffs can also create economic opportunities in both the short and long term:

Job creation and investment: Eli Lilly is investing $5B in a new Virginia plant to manufacture active pharmaceutical ingredients (APIs) domestically, creating over 650 permanent skilled jobs and nearly 1,800 construction jobs.¹³ These investments have created value for a range of stakeholders, including employees, suppliers, and local communities.

Manufacturing rebounds: U.S. auto and parts output has risen in 2025, partly as tariffs on imported cars and metals redirect demand toward domestic plants.¹⁴ Companies have developed new strategies to capitalize on these shifts, further strengthening the sector.

Domestic expansions: Cra-Z-Art, a major U.S. toy maker, announced factory expansions and relocations to increase U.S.-based production as imports became more expensive.¹⁵ The public sector has developed initiatives to support domestic industry growth, helping to sustain these expansions.

Reshoring & nearshoring: Companies are accelerating “China Plus One” and “Anywhere but China” strategies, shifting operations to Mexico, India, and Eastern Europe to reduce reliance on a single source.¹⁶

Supply chain resilience: Tariffs have sped up adoption of advanced analytics, tariff engineering, and automation, turning what were once stop-gap measures into long-term cost efficiencies.¹³

Sectoral competitiveness: Domestic resource industries, particularly in energy, steel, and chemicals, are seeing stronger relative positioning as imports lose ground.¹⁷

These examples illustrate that, while tariffs raise costs, they can also act as catalysts for structural change, pushing firms to invest, innovate, and diversify.

Economically, the burden—and benefits—of tariffs are shared.² Consumers may pay more at the store, but they can also reap the rewards of jobs and investments returning to local economies. Meanwhile, firms that successfully adapt may gain first-mover advantages or capture market share from less agile rivals. To ensure long-term competitiveness, it is crucial for organizations to align their business strategy with clear business goals and proactively plan for the future.

The key for businesses is to build resilience, not just react.¹⁸ Organizations have developed focused strategies to build supply chain resilience, often leveraging agility to respond quickly to changing tariff environments. Short-term responses, like stockpiling inventory before new duties bite, can boost flexibility but also tie up valuable capital and fill up warehouses. More enduring strategies include:

In my work with manufacturing leaders and subject matter experts, I am seeing companies quickly adjust their strategies to fit the current tariff environment. The goal is straightforward: protect margins, maximize top-line growth, and capture short-term gains while the policies are in effect. Nearshoring, onshoring, and “Anywhere but China” sourcing are no longer just ideas under discussion; they are being executed in real time with visible investments in plants, jobs, and supplier diversification.

These moves make sense in the current climate, but they also highlight the adaptive nature of global businesses. Companies are pragmatic. Their plans are designed not only to adapt to shifting trade policies but also to create value for investors and maintain a competitive edge in a changing tariff environment. They will continue to reconfigure supply chains, product portfolios, and pricing models to align with whatever policies are in place. If tariffs remain elevated, the recent wave of investments could become the foundation of a new production landscape. If policies are rolled back, many firms will pivot again, shifting back toward lower-cost global sourcing where it improves competitiveness.

The pattern is clear: businesses use tariffs as a lever, not as a fixed anchor. They optimize operations around today’s rules while leaving themselves room to shift when tomorrow’s rules change. This approach is less about long-term certainty and more about strategic agility.

Acuvity’s supply chain and risk experts help clients cut through the noise.¹ The firm combines robust scenario modeling, global supplier mapping, risk impact assessments, and practical playbooks, turning the complexity of the tariff economy to each client’s advantage. Acuvity’s practice is built on industry-leading practices, ensuring clients achieve optimal outcomes in the tariff economy.

Tariffs aren’t just a tax; they’re an ever-changing challenge and, for prepared businesses, a springboard for advantage. Let Acuvity build your winning strategy, no matter how the numbers move.

Venkat Avasarala Dec 26, 2025

Venkat Avasarala Nov 28, 2025

Venkat Avasarala Oct 31, 2025